Credit Preservation

Divorce itself is not a blow that can be fatal to your credit score, but what happens during the divorce will affect your creditworthiness. Many people report that their credit score falls during a divorce. This can be avoided when individuals protect their credit. Divorce Mortgage Guidance can help you to decide how to preserve your credit.

Important steps for you to state with

To start preserving credit you need to fully understand your situation, therefore the first step will be to obtain your credit reports. Also, you will need to investigate joint accounts and we suggest that you get these accounts closed. If the other spouse uses these accounts to run up debt, then you can be responsible for it. Therefore, separating all credit accounts is an important step in preserving credit. You will also need to notify creditors about your divorce. This is to ensure that you are not liable for any debt after the date that you notified them about the divorce. You must also request that they put the accounts on inactive status so that no new charges can be added by anyone, and once the amount is paid in full, ensure that this account is closed. Make sure that you get monthly statements so that you can keep track of all the accounts and keep track of all the payments that you are making.

What we can do to help

We know that during a divorce, accounts, and debts can be neglected because of the emotional stress that you may be feeling. We do urge you to seek out qualified people such as us to help you with credit preservation. Once you reach out to us, we will go through all of your accounts, as well as your debt. We will also give you advice on how to proceed with managing your credit. We can also advise you on what accounts should be closed immediately.

Our advice

At Divorce Mortgage Guidance, we guide our clients on the best way forward when it comes to their credit and financial situation. In this section, we will take a quick overview of some of our advice to you. We urge you not to fight for the house especially if you are not sure if you can afford it. In some cases, the house can be more of a liability than an asset, and we need to take a look into that. We will also advise you to keep your address updated with creditors, this is to ensure that you receive all your statements. Don't go on any spending binges, also known as revenge spending. You may think that you want to get back at your spouse, but you may end up being liable for the debt. Use your credit cards wisely, remember if you want a higher credit score you need to lower your debt.

When to contact us

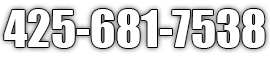

We advise you to contact us as soon as the decision to get divorced is finalized. The sooner you start sorting out your debt, the sooner you will fully understand your financial situation. By understanding your financial situation, you will know if you can keep the house, and it also puts you in a better place to preserve your credit.